To safeguard against dangers and guarantee long-term stability, small companies in the US and Canada must have the proper insurance coverage. Ensuring personalized coverage, affordable pricing, and fast claims help is made easier with a dependable insurance provider. As the year 2025 progresses, a few of insurance companies in North America stand out for their commitment to small enterprises. To ...

In 2025, protecting your company against potential threats is just as important as focusing on development and innovation if you want to be a successful business owner. Maintaining adequate insurance coverage is critical for protecting your business’s assets, workers, and reputation, regardless of the size of your startup, expanding firm, or well-established corporation. But how can you tell which of ...

Cybercriminals target small companies more frequently in today’s always-online society. Cyber threats, including as data breaches, phishing schemes, and ransomware assaults, are on the rise, and with them, the monetary repercussions. By 2025, cyber insurance is accessible to anyone, not just large corporations. It’s an essential tool for small enterprises across all sectors. Whether you own a brick-and-mortar business, an ...

If you want to safeguard your company from unforeseen dangers, getting business insurance is a must. Insurance rates are shifting for Canadian and American enterprises in 2025 due to increased risk exposure caused by inflation, climate change, and cyber risks. But how do the two nearby economies’ rates stack up against one another? This article compares and contrasts commercial insurance ...

When you’re a small company owner, you have a lot on your plate, from payroll and accounting to dealing with customers and staying in compliance with the law. However, company insurance is one area that may easily be neglected. Having the correct insurance coverage is crucial in 2025 due to the increasing digital dangers, economic volatility, and changing legislation. Make ...

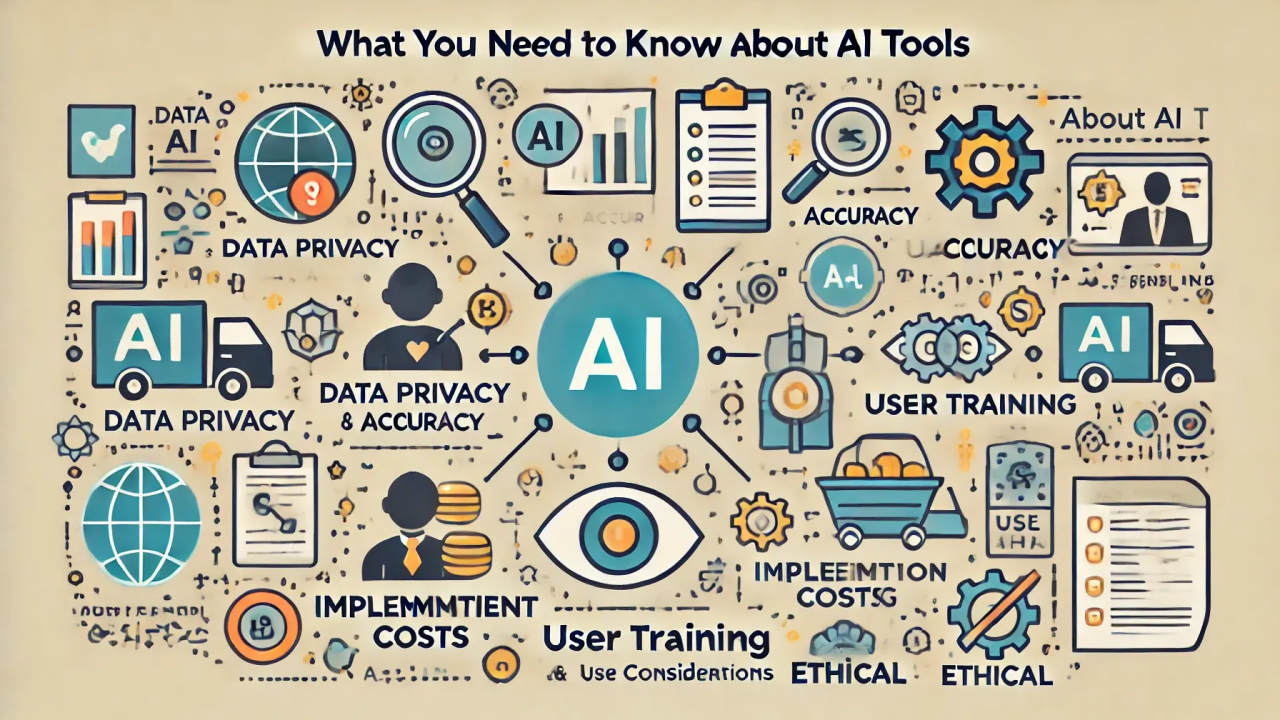

The freelancing industry is seeing unprecedented levels of change in 2025. Artificial intelligence (AI) is becoming more popular among freelancers as a means to overcome increasing competition, stricter deadlines, and higher customer demands. The use of artificial intelligence (AI) technologies is revolutionizing the way freelancers do a wide range of jobs, from writing and design to coding and project management. ...

There is a lot of change, competition, and speed in the freelancing industry. Maintaining productivity and producing high-quality work is crucial for every profession. AI is going to be useful in such situation. By 2025, AI technologies are indispensable for working smarter, not harder; they are no longer seen as far-fetched luxury items. To assist freelancers succeed, we’ve compiled a ...

The world of freelancing is dynamic and dynamically evolving. Freelancers need time-saving, error-reducing, and output-improving technologies in addition to skill if they want to remain competitive. For independent developers, designers, and writers, artificial intelligence (AI) has quickly become a reliable partner. By 2025, these technologies will be indispensable for every freelancer looking to make it big. If you’re a freelancer, ...

Starting out as a freelancer is both a thrilling and daunting prospect. Juggling customer expectations, creative responsibilities, and administrative chores may be a real challenge for writers, designers, and developers. Even if you’re just starting out, you may benefit from the strong tools that artificial intelligence (AI) offers to ease your work. To help you work smarter, not harder, here ...

The independence and flexibility of freelancing isn’t without its challenges, though, such as meeting deadlines while juggling a wide variety of responsibilities and clients’ demands. Artificial intelligence (AI) solutions may automate mundane tasks, enhance the quality of your work, and simplify your workflow, all while saving you time. In 2025, improve your freelancing workflow with these 10 top AI technologies. ...