Australia’s real estate market is a cornerstone of the nation’s economy, known for its resilience, diversity, and appeal to both local and international investors. From sprawling suburban developments to luxurious waterfront homes and bustling urban centers, the Australian property sector offers opportunities across various demographics and investment strategies.

Market Dynamics

Australia’s real estate market is shaped by key economic and social factors. High population growth, driven by immigration and natural increase, fuels demand for housing, particularly in urban areas. Cities like Sydney, Melbourne, Brisbane, and Perth dominate the market due to their economic activity, job opportunities, and lifestyle appeal.

The market is also influenced by interest rates. In recent years, fluctuations in borrowing costs, influenced by the Reserve Bank of Australia (RBA), have significantly impacted buyer behavior. Lower interest rates spurred a surge in property prices, while recent rate hikes have moderated growth, making affordability a critical issue.

Residential Real Estate

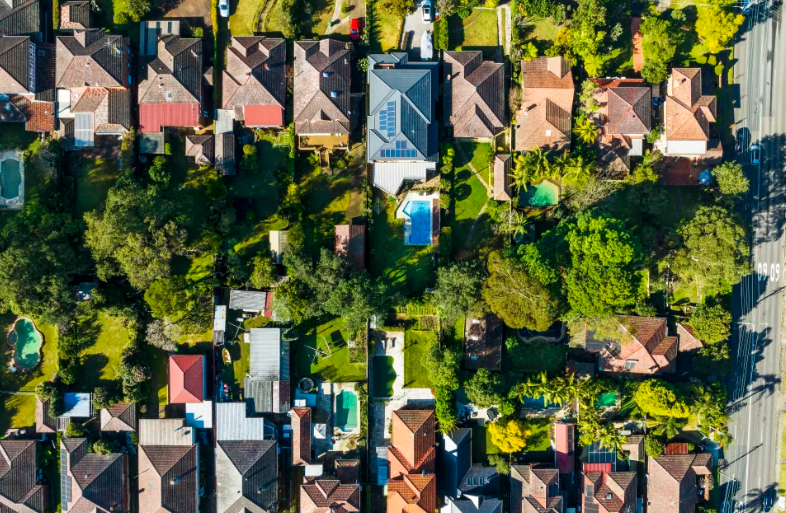

Australia’s residential market is diverse, catering to a wide range of buyers and renters. Demand remains strong for detached houses in suburban areas, particularly among families. Meanwhile, younger professionals gravitate toward apartments and townhouses in urban centers, where access to work, amenities, and public transport is prioritized.

One of the biggest challenges in the residential sector is affordability. Property prices in major cities like Sydney and Melbourne rank among the highest globally, putting pressure on first-time buyers. To counter this, the government has implemented initiatives like the First Home Loan Deposit Scheme, helping Australians enter the property market.

Commercial and Industrial Real Estate

Australia’s commercial property market has shown resilience, supported by strong demand for office, retail, and industrial spaces. While traditional office spaces faced a downturn during the pandemic due to remote work trends, the rise of hybrid work models has reinvigorated the demand for flexible and co-working spaces.

The industrial sector is a standout performer, driven by the growth of e-commerce and supply chain logistics. Warehouses and distribution centers, particularly in proximity to major urban hubs, have become highly sought after.

Regional Markets

Australia’s regional property markets have gained attention in recent years, driven by the “tree-change” and “sea-change” trends. As remote work becomes more feasible, many Australians are relocating to coastal and rural areas for a better quality of life. Locations like Byron Bay, Geelong, and Sunshine Coast have seen significant growth in property values, driven by this shift.

Sustainability in Real Estate

Sustainability is a growing focus in Australia’s real estate sector. Developers are increasingly incorporating energy-efficient designs, renewable energy systems, and green building materials to meet environmental standards and appeal to eco-conscious buyers.

Opportunities and Challenges

Australia’s real estate market offers vast opportunities, particularly in affordable housing, urban renewal projects, and infrastructure-linked developments. However, it also faces challenges, including housing supply shortages, rising construction costs, and regulatory complexities.

Conclusion

Australia’s real estate market remains a dynamic and rewarding sector for investors and homeowners alike. As the country continues to adapt to economic shifts, demographic changes, and sustainability goals, its property market will likely remain a key pillar of economic growth and a critical driver of wealth creation. For investors, understanding regional trends and navigating market challenges are essential for maximizing returns in this ever-evolving landscape.

Leave a Reply