The global economy is becoming increasingly vulnerable as it becomes more interconnected. One truth is evident: **our current financial system is not equipped to address the challenges of the 21st century, from the 2008 financial crisis to the COVID-19 pandemic to ongoing climate-related shocks.**

The encouraging news? We are both obligated and have the opportunity to reimagine global finance in accordance with three fundamental principles: **equity**, **efficiency**, and **emergency preparedness**. This is not a matter of adjusting interest rates or redistributing debt burdens. It involves a daring reevaluation of the manner in which we organize, govern, and deploy financial power in a world of shared risks and responsibilities.

The Reasons for the Need for Global Finance Reform

The global financial architecture, which was primarily constructed following World War II, has fostered substantial development for several decades. However, it has also failed to meet the needs of many and has been found to be insufficient or sluggish during times of crisis. Take into account:

* **Inequity**: The most impoverished nations are the most susceptible to debt and climate disruptions, have the least access to capital, and pay the highest interest rates.

* **Inefficiency**: Critical investments in infrastructure, climate resilience, and healthcare remain unfunded, while trillions of dollars in global capital remain inactive or pursue short-term gains.

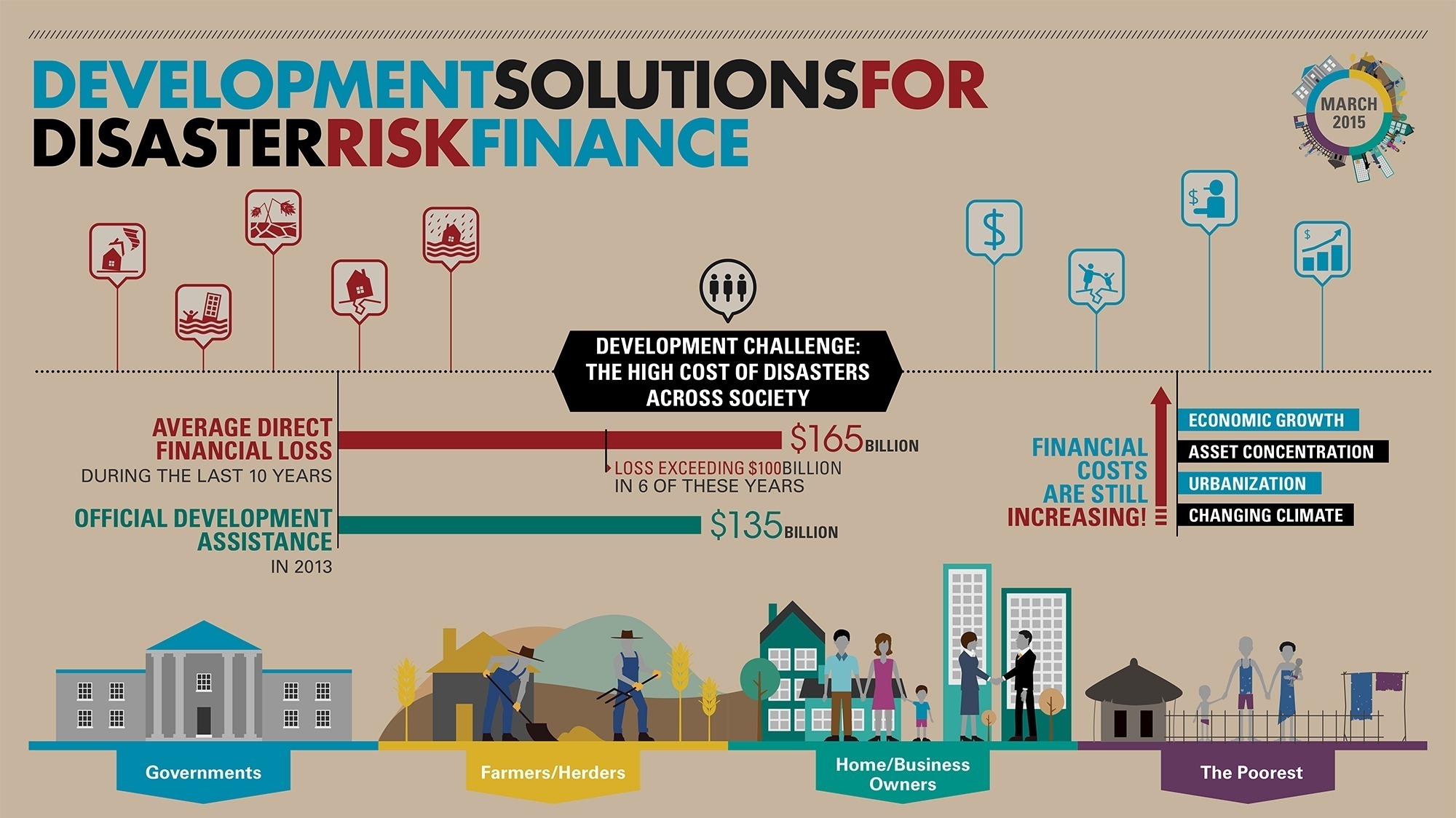

* **Inadequate Preparation**: The pandemic response, food shocks, and energy disruptions—each crisis exposed a perilous lack of financial preparedness and global coordination.

It is evident that it is time to modernize.

Equity: Equalizing the Financial Landscape

Access to opportunity—not merely survival—is the essence of genuine equity in global finance. Currently, numerous developing nations are ensnared in cycles of underinvestment, austerity, and debt.

**What must be altered:**

* **Debt reform**: Establish debt restructuring mechanisms that are equitable, transparent, and timely, including those for private creditors.

* **Capital Accessibility**: Reallocate unused Special Drawing Rights (SDRs) to vulnerable countries and increase concessional financing.

* **Voice in governance**: Revise the voting structures of the IMF, World Bank, and other institutions to ensure that the Global South has a legitimate presence at the table.

While half of the world is compelled to operate on the fringes of the global economy, it is impossible to establish a fair global economy.

Optimizing Efficiency: Optimizing Money’s Intelligent Use

Financial inefficiency is not only wasteful, but also unjust in a world of unmet need and excess liquidity. It exacerbates inequality, weakens resilience, and delays climate action.

**Steps to enhance:**

* **Blended finance**: Use public funds to de-risk and crowd in private capital for long-term investments in renewable energy, health systems, and digital infrastructure.

* **Digital transformation**: Utilize fintech to enhance transparency, decrease corruption, and expedite the delivery of aid, particularly in fragile states.

* **Results-based financing**: Transition global aid and lending to impact-oriented models that incentivize genuine progress rather than mere expenditures.

The objective is not to increase expenditures; rather, it is to optimize expenditures.

Emergency Preparedness: A Financial Firewall for the Future

Crisises are no longer the exception; they are the rule. The world requires **financial firewalls** that are global, flexible, and rapid, regardless of whether it is a new pandemic, a geopolitical shock, or a climate catastrophe.

**What we require:**

* **A Global Crisis Fund**: A pre-funded, aggregated mechanism that can rapidly distribute assistance in the event of an emergency, with a particular emphasis on low-income countries.

* **Climate disaster insurance**: Sovereign insurance programs and enlarged risk pooling for countries that are at the forefront of the climate crisis.

* **Agile institutions**: Multilateral banks and donors must achieve greater responsiveness by implementing quicker deployment mechanisms and reducing red tape.

Consider the scenario in which the world had responded to COVID-19 in weeks rather than months. The disparity would have been quantified in millions of lives and livelihoods.

A Framework for Collective Action

The redesign of global finance is not merely a technocratic endeavor; it is a moral and strategic necessity. It signifies:

* **Rebalancing power** to align with contemporary circumstances, rather than post-war politics.

* **Recognizing resilience**, rather than solely credit ratings.

* **Assembling funds** for the benefit of the public, rather than for personal gain.

In order to transition from a reactive to a **proactive** paradigm of global finance, it is imperative that governments, international institutions, private investors, and civil society collaborate.

The Future

A financial system that has been reimagined has the potential to unleash the investments necessary for a sustainable, inclusive future, including gender equality, pandemic preparedness, and decarbonization.

However, it commences with political will, courageous leadership, and a shared comprehension: **Finance is not solely about numbers. It pertains to individuals.

In a century characterized by uncertainty, it is no longer feasible to maintain antiquated systems that benefit a select few while failing the majority. The moment has arrived to reimagine global finance.

Leave a Reply