In recent years, cryptocurrency has experienced substantial growth, transitioning from a niche digital asset to a recognizable method of value transmission. One area that is garnering increasing attention is the utilization of crypto payments for significant transactions, such as real estate, prestige vehicles, and high-value business agreements. However, what is the current practicality of cryptocurrencies for such significant expenditures, and what does the future hold?

Benefits of Cryptocurrency for Large Transactions

There are numerous compelling factors why cryptocurrencies may be well-suited for high-value payments:

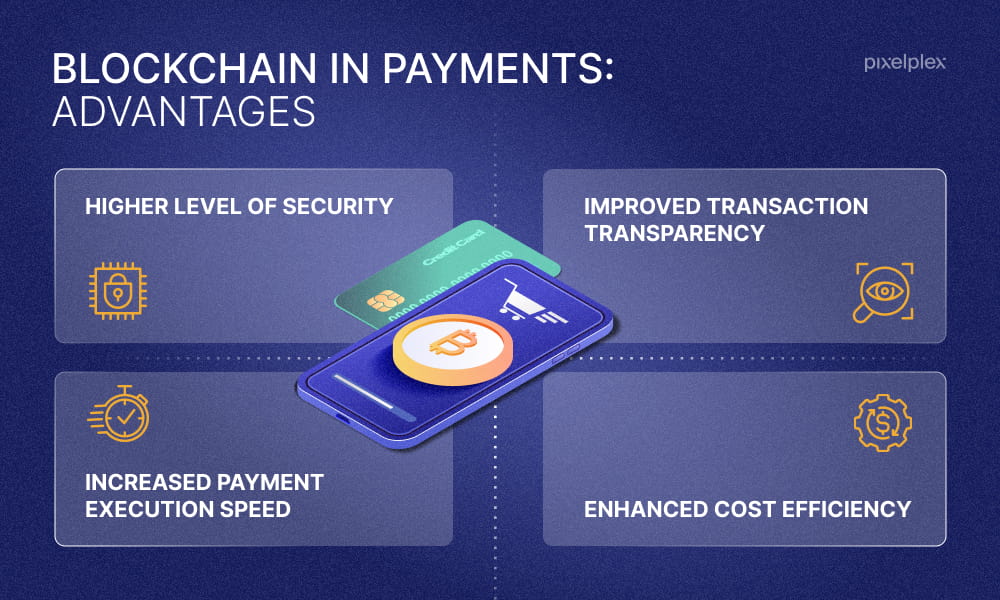

* **Efficiency and Speed:** In contrast to conventional bank transfers, particularly those that involve international transactions, crypto payments can be settled within minutes. This has the potential to expedite the completion of transactions and decrease the duration of waiting periods for both consumers and sellers.

* **Reduced Costs:** Crypto transactions have the potential to reduce or eradicate intermediaries, such as correspondent banks and payment processors, resulting in reduced fees, particularly for cross-border transactions.

* **International Accessibility:** Cryptocurrencies are transnational, enabling parties from various countries to conduct transactions without the complications of currency conversion or capital constraints.

* **Security and Transparency:** Blockchain technology provides a transparent, immutable ledger of transactions that increases trust and reduces the risk of fraud.

* **Financial Sovereignty:** Buyers and vendors maintain control over their funds without the need to rely on third parties, which is alluring to individuals who value autonomy and privacy.

Obstacles to Practicality

Nevertheless, the practicality of crypto payments for large transactions is currently restricted by a number of factors, despite these advantages:

* **Volatility of Prices:** The value of numerous cryptocurrencies can fluctuate substantially within brief periods, which introduces risk and uncertainty into transactions. This complicates the process of determining the value of assets and establishing payment terms without the immediate conversion to stablecoins or fiat currency.

* **Regulatory and Legal Uncertainty:** Complexity and potential risks are introduced into large transactions by the diverse regulations regarding taxation, compliance, and crypto payments in various jurisdictions.

* **Inadequate Merchant and Service Infrastructure:** The systems and expertise necessary to confidently accept and process crypto payments are still lacking in numerous real estate agencies, auto dealerships, and corporate vendors.

* **Economic Consequences:** The transaction process can be complicated by the requirement for detailed reporting and the triggering of capital gains taxation for large crypto payments.

New Approaches to Enhance Practicality

In order to surmount these obstacles, numerous initiatives are currently in progress:

* **Stablecoins:** Digital currencies that are pegged to fiat values provide stability and simplify pricing, thereby reducing volatility concerns.

* **Instant Conversion Services:** Payment processors now allow vendors to accept cryptocurrency and convert it to fiat currency promptly, thereby reducing their exposure to market fluctuations.

* **Progress in Regulatory Matters:** Governments are increasingly collaborating to establish transparent frameworks for cryptocurrency transactions, which will enhance legal certainty and mitigate risks.

* **Infrastructure and Education:** Businesses are increasingly investing in staff training and implementing crypto-friendly payment platforms to facilitate the seamless processing of digital currency transactions.

What the Future May Hold

The practicality and widespreadness of crypto payments for large transactions will increase as these enhancements become established. We can anticipate the following:

* A greater number of real estate and automotive sales are advertised and concluded in cryptocurrency.

* The increasing utilization of blockchain-based smart contracts to automate and secure payments.

* Enhanced institutional adoption and integration with conventional finance.

* Increased global accessibility for consumers and merchants without the need for banking intermediaries.

In conclusion,

The transition from experimental to practicality of crypto payments for large transactions is occurring at an accelerated pace. Although issues such as infrastructure, regulation, and volatility persist, the continued adoption and innovation of digital currencies are facilitating the development of more efficient, secure, and streamlined high-value transactions. Cryptocurrencies may soon become the preferable payment method for large purchases for buyers and vendors who are prepared to embrace the future.

Leave a Reply