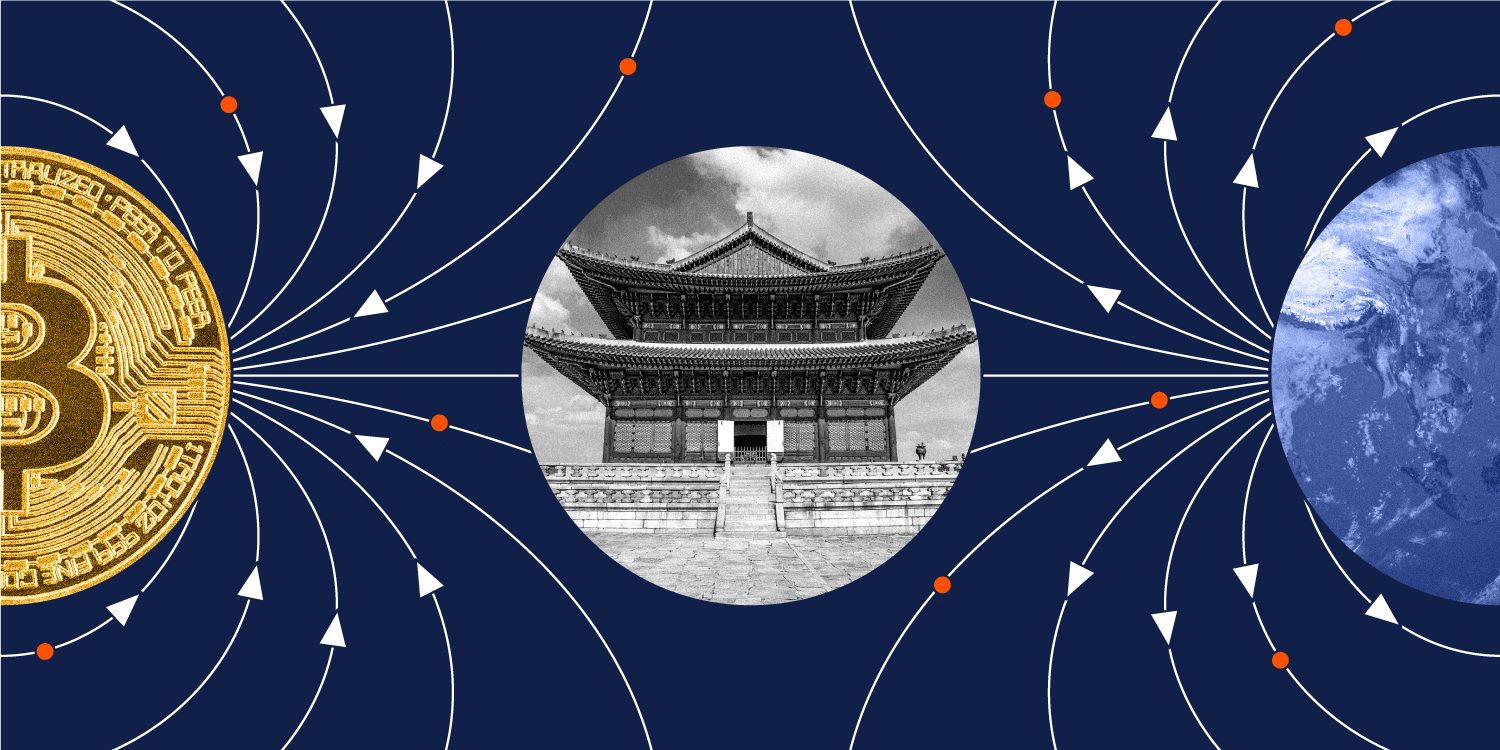

For an extended period, Asia has been a dominant force in the fields of finance, technology, and innovation. The continent is situated at the intersection of conventional finance and the emerging Web3 world, with bustling fintech hubs in Singapore and Hong Kong and massive crypto user bases in South Korea, Japan, India, and Southeast Asia.

**Will Asia dominate the future of Web3 finance?** is a question that many experts are asking as the global blockchain revolution unfolds. The solution is a combination of market demand, innovation ecosystems, regulatory approaches, and geopolitical factors.

Today’s Cryptocurrency Scene in Asia

The crypto environment in Asia is both dynamic and diverse:

* **China**: Despite its prohibition of crypto trading and mining, China is actively advancing blockchain technology and has been a pioneer in the development of its digital yuan CBDC.

**Singapore**: Known for its clear regulations and crypto-friendly policies, Singapore is a popular destination for blockchain investors, entrepreneurs, and exchanges.

* **South Korea and Japan**: Both countries have robust regulatory frameworks and high rates of crypto adoption, which promotes consumer protection and innovation.

* **India**: A vast untapped market, with a burgeoning crypto-savvy youth population, but an evolving regulatory stance.

* **Southeast Asia**: The Philippines, Indonesia, and Vietnam are rapidly adopting cryptocurrency for DeFi, gambling, and remittances.

This combination of market maturity and regulatory environments generates both opportunities and challenges.

The Reasons Why Asia Could Be the Leader in Web3 Finance

1. **Adoption of Technology and a Large User Base**

Asia is home to more than half of the world’s internet consumers, and the penetration of smartphones is increasing at a rapid pace. This generates an extensive market for Web3 applications, including blockchain gaming, non-fungible tokens (NFTs), and decentralized financing (DeFi).

2. **Innovation in the Private Sector and Government**

Several Asian governments are taking a proactive approach to blockchain research and development, regulatory sandboxes, and public-private partnerships, which is fostering the experimentation and scaling of both entrepreneurs and incumbents.

3. **Infrastructure and Capital**

Blockchain ventures are receiving billions of dollars in investment from global financial centers such as Singapore, Hong Kong, and Tokyo. In the interim, the infrastructure for blockchain development, mining (where permitted), and education is expanding.

4. **Cultural Preference for Digital Assets**

In numerous Asian countries, crypto is already recognized as a critical instrument for wealth preservation, particularly in regions where fiat currencies are subject to capital controls or inflation.

Obstacles in the Future

* **Regulatory Uncertainty**: Singapore’s openness is in stark contrast to China’s stringent stance. Fragmentation is a result of the ongoing debate regarding frameworks in countries such as India.

* **Geopolitical Tensions**: The flow of innovation and capital could be influenced by the U.S.-China tech rivalry and regional security issues.

* **Education and Inclusion**: It is essential to bridge the gap for less tech-savvy populations in order to facilitate universal adoption.

What does the future hold?

The role of Asia in Web3 finance is expected to be **multipolar and evolving**.

* Certain centers, such as Singapore and South Korea, have the potential to become global leaders in regulated DeFi and digital asset markets. Cross-border payments and CBDC interoperability may be significantly altered by China’s state-backed digital currency initiatives. Crypto use cases for the unbanked, such as remittances and decentralized financing, could be pioneered by emerging economies in Southeast Asia.

Concluding thoughts

Asia is a **hotbed for the next iteration of Web3 finance** due to its combination of scale, innovation, and diverse markets. Although regulatory and geopolitical obstacles continue to exist, the digital future of the East is replete with prospects.

The question is not merely whether Asia will dominate, but rather how it will influence a global Web3 ecosystem that is interconnected, innovative, and inclusive.

**What are your thoughts? Will Asia be the driving force behind Web3 finance? Comment below with your thoughts!

Leave a Reply